Einde inhoudsopgave

Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II)

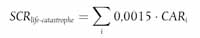

Article 96 Simplified calculation of the capital requirement for life-catastrophe risk

Geldend

Geldend vanaf 18-01-2015

- Bronpublicatie:

10-10-2014, PbEU 2015, L 12 (uitgifte: 17-01-2015, regelingnummer: 2015/35)

- Inwerkingtreding

18-01-2015

- Bronpublicatie inwerkingtreding:

10-10-2014, PbEU 2015, L 12 (uitgifte: 17-01-2015, regelingnummer: 2015/35)

- Vakgebied(en)

Financieel recht / Europees financieel recht

Financieel recht / Financieel toezicht (juridisch)

Verzekeringsrecht / Europees verzekeringsrecht

Verzekeringsrecht / Bijzondere onderwerpen

Where Article 88 is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life-catastrophe risk calculated as follows:

where:

- (a)

the sum includes all policies with a positive capital at risk;

- (b)

CARi denotes the capital at risk of the policy i, meaning the higher of zero and the difference between the following amounts:

- (i)

the sum of:

- —

the amount that the insurance or reinsurance undertaking would currently pay in the event of the death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

- —

the expected present value of amounts not covered in the previous indent that the insurance or reinsurance undertaking would pay in the future in the event of the immediate death of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

- (ii)

the best estimate of the corresponding obligations after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles.