Einde inhoudsopgave

Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II)

Article 93 Simplified calculation of the capital requirement for life disability-morbidity risk

Geldend

Geldend vanaf 18-01-2015

- Bronpublicatie:

10-10-2014, PbEU 2015, L 12 (uitgifte: 17-01-2015, regelingnummer: 2015/35)

- Inwerkingtreding

18-01-2015

- Bronpublicatie inwerkingtreding:

10-10-2014, PbEU 2015, L 12 (uitgifte: 17-01-2015, regelingnummer: 2015/35)

- Vakgebied(en)

Financieel recht / Europees financieel recht

Financieel recht / Financieel toezicht (juridisch)

Verzekeringsrecht / Europees verzekeringsrecht

Verzekeringsrecht / Bijzondere onderwerpen

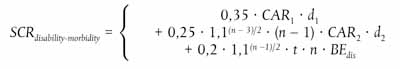

Where 88[lees: Article 88] is complied with, insurance and reinsurance undertakings may calculate the capital requirement for life disability-morbidity risk as follows:

where with respect to insurance and reinsurance policies with a positive capital at risk:

- (a)

CAR1 denotes the total capital at risk, meaning the sum over all contracts of the higher of zero and the difference between the following amounts:

- (i)

the sum of:

- —

the amount that the insurance or reinsurance undertaking would currently pay in the event of the death or disability of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

- —

the expected present value of amounts not covered in the previous indent that the insurance or reinsurance undertaking would pay in the future in the event of the immediate death or disability of the persons insured under the contract after deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles;

- (ii)

the best estimate of the corresponding obligations after deduction of the amounts recoverable form reinsurance contracts and special purpose vehicles;

- (b)

CAR2 denotes the total capital at risk as defined in point (a) after 12 months;

- (c)

d1 denotes the expected average disability-morbidity rate during the following 12 months weighted by the sum insured;

- (d)

d2 denotes the expected average disability-morbidity rate in the 12 months after the following 12 months weighted by the sum insured;

- (e)

n denotes the modified duration of the payments on disability-morbidity included in the best estimate;

- (f)

t denotes the expected termination rates during the following 12 months;

- (g)

BEdis denotes the best estimate of obligations subject to disability-morbidity risk.