Einde inhoudsopgave

Convention on temporary admission

Annex A

Geldend

Geldend vanaf 11-05-2017

- Bronpublicatie:

11-11-2016, Trb. 2016, 207 (uitgifte: 30-12-2016, kamerstukken/regelingnummer: -)

- Inwerkingtreding

11-05-2017

- Bronpublicatie inwerkingtreding:

11-11-2016, Trb. 2016, 207 (uitgifte: 30-12-2016, kamerstukken/regelingnummer: -)

- Vakgebied(en)

Internationaal publiekrecht / Vrij verkeer

Annex concerning temporary admission papers (ATA carnets and CPD carnets)

Chapter I. Definitions

Article 1

For the purposes of this Annex, the term:

- a)

‘temporary admission papers’ means:

the international Customs document accepted as a Customs declaration which makes it possible to identify goods (including means of transport) and which incorporates an internationally valid guarantee to cover import duties and taxes;

- b)

‘ATA carnet’ means:

the temporary admission papers used for the temporary admission of goods, excluding means of transport;

- c)

‘CPD carnet’ means:

the temporary admission papers used for the temporary admission of means of transport;

- d)

‘guaranteeing chain’ means:

a guaranteeing scheme administered by an international organization to which guaranteeing associations are affiliated;

- e)

‘international organization’ means:

an organization to which national associations authorized to guarantee and issue temporary admission papers are affiliated;

- f)

‘guaranteeing association’ means:

an association approved by the Customs authorities of a Contracting Party to guarantee the sums referred to in Article 8 of this Annex, in the territory of that Contracting Party, and affiliated to a guaranteeing chain;

- g)

‘issuing association’ means:

an association approved by the Customs authorities to issue temporary admission papers and affiliated directly or indirectly to a guaranteeing chain;

- h)

‘corresponding issuing association’ means:

an issuing association established in another Contracting Party and affiliated to the same guaranteeing chain;

- i)

‘Customs transit’ means:

the Customs procedure under which goods are transported under Customs control from one Customs office to another.

Chapter II. Scope

Article 2

1

In accordance with Article 5 of this Convention, each Contracting Party shall accept in lieu of its national Customs documents, and as due security for the sums referred to in Article 8 of this Annex, temporary admission papers valid for its territory and issued and used in accordance with the conditions laid down in the Annex for goods (including means of transport), temporarily imported under the other Annexes to this Convention which it has accepted.

2

Each Contracting Party may also accept temporary admission papers, issued and used under the same conditions, for temporary admission operations under its national laws and regulations.

3

Each Contracting Party may accept temporary admission papers, issued and used under the same conditions, for Customs transit.

4

Goods (including means of transport), intended to be processed or repaired shall not be imported under cover of temporary admission papers.

Article 3

1

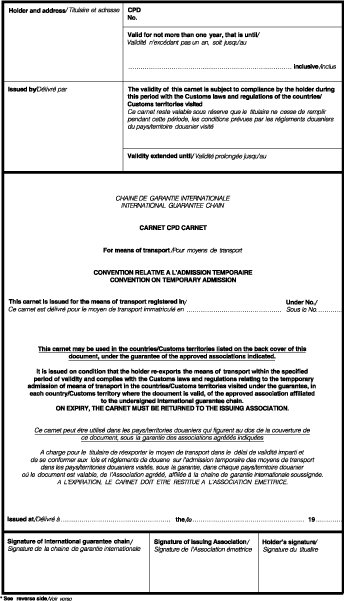

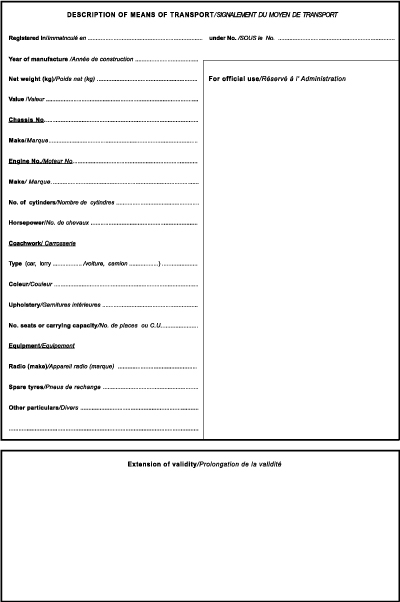

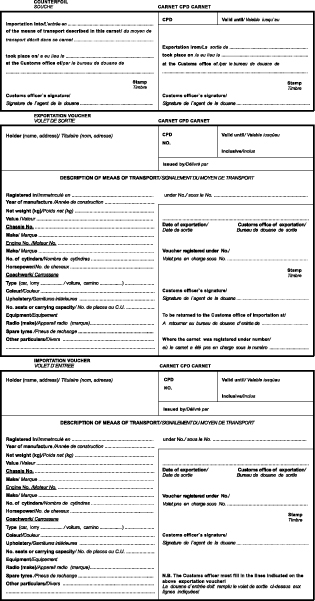

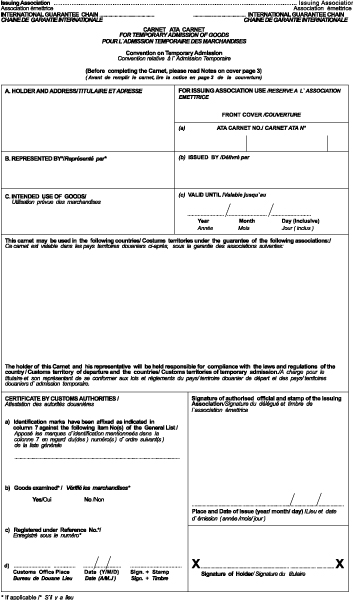

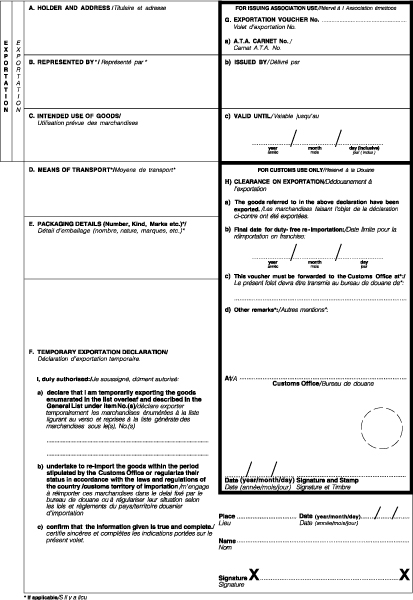

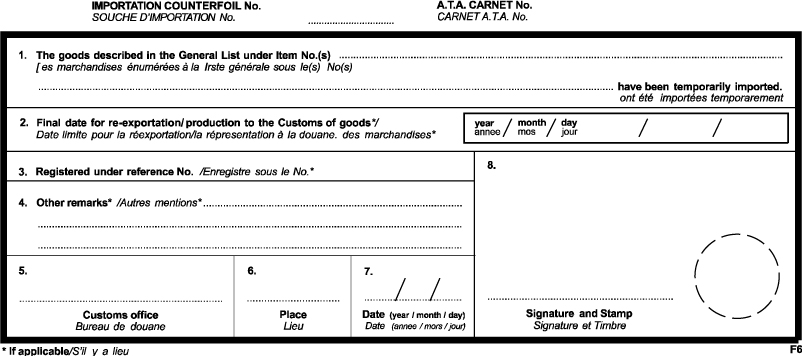

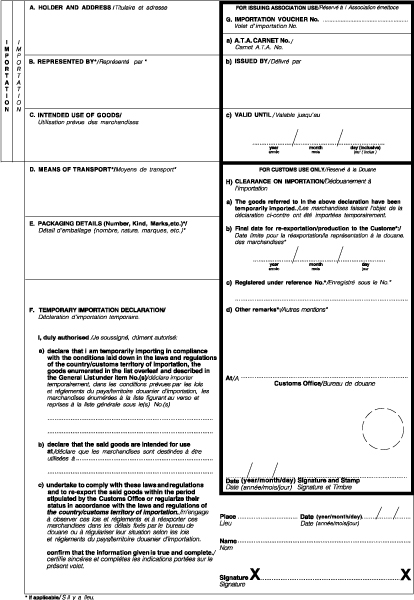

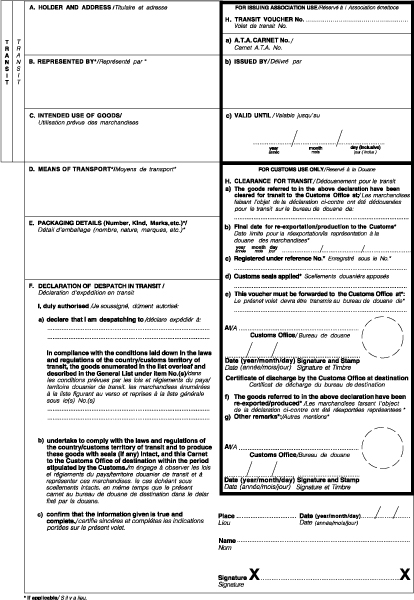

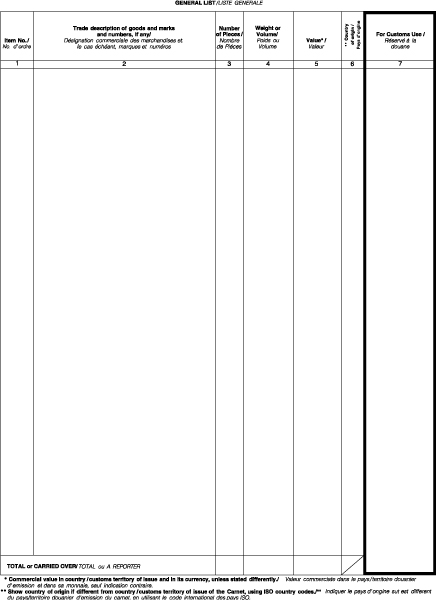

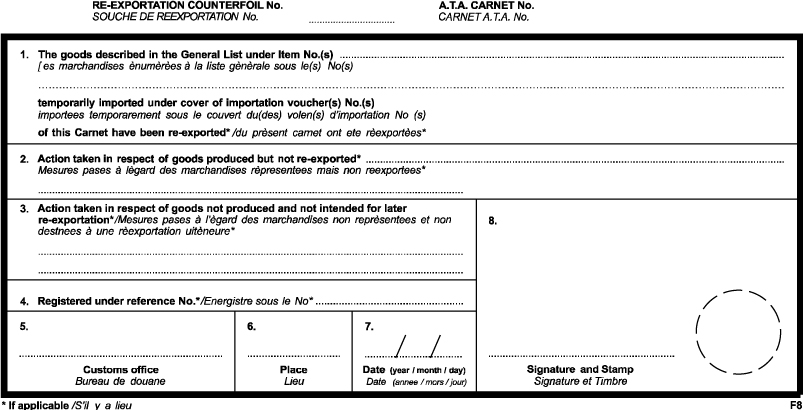

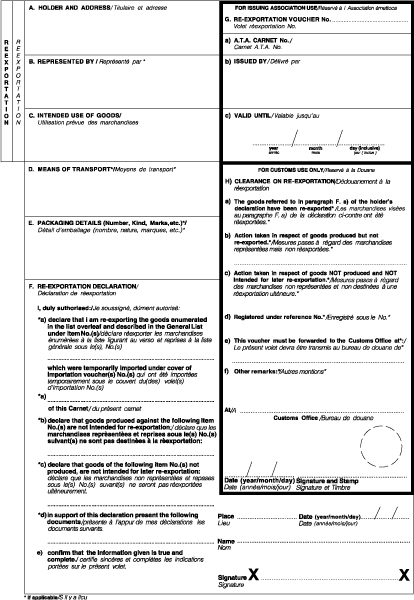

Temporary admission papers shall correspond to the models set out in the Appendices to this Annex: Appendix I for ATA carnets, Appendix II for CPD carnets.

2

The Appendices to this Annex shall be construed to be an integral part of the Annex.

Chapter III. Guarantee and issue of temporary admission papers

Article 4

1

Subject to such conditions and guarantees as it shall determine, each Contracting Party may authorize guaranteeing associations to act as guarantors and to issue temporary admission papers, either directly or through issuing associations.

2

A guaranteeing association shall not be approved by any Contracting Party unless its guarantee covers the liabilities incurred in that Contracting Party in connection with operations under cover of temporary admission papers issued by corresponding issuing associations.

Article 5

1

Issuing associations shall not issue temporary admission papers with a period of validity exceeding one year from the date of issue.

2

Any particulars inserted on temporary admission papers by the issuing associations may be altered only with the approval of the issuing or guaranteeing association. No alteration to those papers may be made after they have been accepted by the Customs authorities of the territory of temporary admission, except with the consent of those authorities.

3

Once an ATA carnet has been issued, no extra item shall be added to the list of goods enumerated on the reverse of the front cover of the carnet, or on any continuation sheets appended thereto (General list).

Article 6

The following particulars shall appear on the temporary admission papers:

- —

the name of the issuing association;

- —

the name of the international guaranteeing chain;

- —

the countries or Customs territories in which the temporary admission papers are valid; and

- —

the names of the guaranteeing associations of the countries of Customs territories in question.

Article 7

The period fixed for the re-exportation of goods (including means of transport) imported under cover of temporary admission papers shall not in any case exceed the period of validity of those papers.

Chapter IV. Guarantee

Article 8

1

Each guaranteeing association shall undertake to pay to the Customs authorities of the Contracting Party in the territory of which it is established the amount of the import duties and taxes and any other sums, excluding those referred to in Article 4, paragraph 4, of this Convention, payable in the event of non-compliance with the conditions of temporary admission, or of Customs transit, in respect of goods (including means of transport) introduced into that territory under cover of temporary admission papers issued by a corresponding issuing association. It shall be liable jointly and severally with the persons from whom the sums mentioned above are due, for payment of such sums.

2

ATA carnet:

The liability of the guaranteeing association shall not exceed the amount of the import duties and taxes by more than ten percent.

CPD carnet:

The guaranteeing association shall not be required to pay a sum greater than the total amount of the import duties and taxes, together with interest if applicable.

3

When the Customs authorities of the territory of temporary admission have unconditionally discharged temporary admission papers in respect of certain goods (including means of transport), they can no longer claim from the guaranteeing association payment of the sums referred to in paragraph 1 of this Article in respect of these goods (including means of transport). A claim may nevertheless still be made against the guaranteeing association if it is subsequently discovered that the discharge of the papers was obtained improperly or fraudulently or that there had been a breach of the conditions of temporary admission or of Customs transit.

4

ATA carnet:

Customs authorities shall not in any circumstances require from the guaranteeing association payment of the sums referred to in paragraph 1 of this Article if a claim has not been made against the guaranteeing association within a year of the date of expiry of the validity of the ATA carnet.

5

CPD carnet:

Customs authorities shall not in any circumstances require from the guaranteeing association payment of the sums referred to in paragraph 1 of this Article if notification of the non-discharge of the CPD carnet has not been given to the guaranteeing association within a year of the date of expiry of the validity of the carnet. Furthermore, the Customs authorities shall provide the guaranteeing association with details of the calculation of import duties and taxes due within one year from the notification of the non-discharge. The guaranteeing association's liability for these sums shall cease if such information is not furnished within this one year period.

Chapter V. Regularization of temporary admission papers

Article 9

1

ATA carnet:

- a)

The guaranteeing association shall have a period of six months from the date of the claim made by the Customs authorities for the sums referred to in Article 8, paragraph 1 of this Annex in which to furnish proof of re-exportation under the conditions laid down in this Annex or of any other proper discharge of the ATA carnet.

- b)

If such proof is not furnished within the time allowed the guaranteeing association shall forthwith deposit, or pay provisionally, such sums. This deposit or payment shall become final after a period of three months from the date of the deposit or payment. During the latter period, the guaranteeing association may still furnish the proof referred to in subparagraph (a) of this paragraph with a view to recovery of the sums deposited or paid.

- c)

For Contracting Parties whose laws and regulations do not provide for the deposit or provisional payment of import duties and taxes, payments made in conformity with the provisions of subparagraph (b) of this paragraph shall be regarded as final, but the sums paid shall be refunded if the proof referred to in subparagraph (a) of this paragraph is furnished within three months of the date of the payment.

2

CPD carnet:

- a)

The guaranteeing association shall have a period of one year from the date of notification of the non-discharge of CPD carnets in which to furnish proof of re-exportation under the conditions laid down in this Annex or of any other proper discharge of the CPD carnet. Nevertheless, this period can come into force only as of the date of expiry of the CPD carnet. If the Customs authorities contest the validity of the proof provided they must so inform the guaranteeing association within a period not exceeding one year.

- b)

If such proof is not furnished within the time allowed the guaranteeing association shall deposit, or pay provisionally, within a maximum period of three months the import duties and taxes payable. This deposit or payment shall become final after a period of one year from the date of the deposit or payment. During the latter period, the guaranteeing association may still furnish the proof referred to in subparagraph (a) of this paragraph with a view to recovery of the sums deposited or paid.

- c)

For Contracting Parties whose laws and regulations do not provide for the deposit or provisional payment of import duties and taxes, payments made in conformity with the provisions of subparagraph (b) of this paragraph shall be regarded as final, but the sums paid shall be refunded if the proof referred to in subparagraph (a) of this paragraph is furnished within a year of the date of the payment.

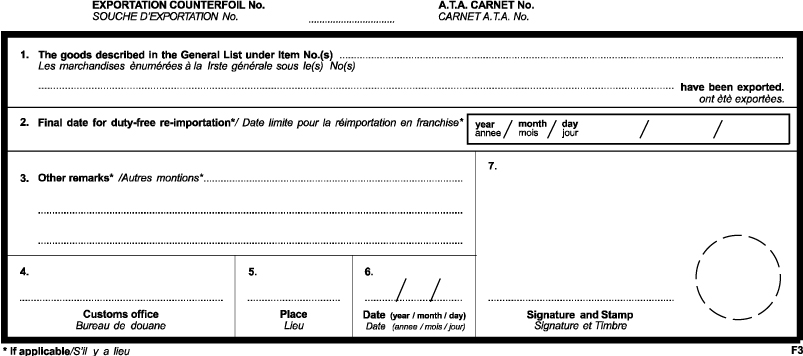

Article 10

1

Evidence of re-exportation of goods (including means of transport) imported under cover of temporary admission papers shall be provided by the re-exportation counterfoil completed and stamped by the Customs authorities of the territory of temporary admission.

2

If the re-exportation has not been certified in accordance with paragraph 1 of this Article, the Customs authorities of the territory of temporary admission may, even if the period of validity of the papers has already expired, accept as evidence of re-exportation:

- a)

the particulars entered by the Customs authorities of another Contracting Party in the temporary admission papers on inportation or reimportation or a certificate issued by those authorities based on the particulars entered on a voucher which has been detached from the papers on importation or on reimportation into their territory, provided that the particulars relate to an importation or reimportation which can be proved to have taken place after the re-exportation which it is intended to establish;

- b)

any other documentary proof that the goods (including means of transport) are outside that territory.

3

In any case in which the Customs authorities of a Contracting Party waive the requirement of re-exportation of certain goods (including means of transport) admitted into their territory under cover of temporary admission papers, the guaranteeing association shall be discharged from its obligations only when those authorities have certified in the papers that the position regarding those goods (including means of transport) has been regularized.

Article 11

In the cases referred to in Article 10, paragraph 2 of this Annex, the Customs authorities shall have the right to charge a regularization fee.

Chapter VI. Miscellaneous provisions

Article 12

Customs endorsements on temporary admission papers used under the conditions laid down in this Annex shall not be subject to the payment of charges for Customs attendance at Customs offices during the normal hours of business.

Article 13

In the case of the destruction, loss or theft of temporary admission papers while the goods (including means of transport) to which they refer are in the territory of one of the Contracting Parties, the Customs authorities of that Contracting Party shall, at the request of the issuing association and subject to such conditions as those authorities may prescribe, accept replacement papers, the validity of which expires on the same date as that of the papers which they replace.

Article 14

1

Where it is expected that the temporary admission operation will exceed the period of validity of the temporary admission papers because of the inability of the holder to re-export the goods (including means of transport) within that period, the association which issued the papers may issue replacement papers. Such papers shall be submitted to the Customs authorities of the Contracting Parties concerned for control. When accepting the replacement papers, the Customs authorities concerned shall discharge the papers replaced.

2

The validity of CPD carnets can only be extended once for not more than one year. After this period, a new carnet must be issued in replacement of the former carnet and accepted by the Customs authorities.

Article 15

Where Article 7, paragraph 3, of this Convention applies, the Customs authorities shall, as far as possible, notify the guaranteeing association of seizures made by them or on their behalf of goods (including means of transport) admitted under cover of temporary admission papers guaranteed by that association and shall advise it of the measures they intend to take.

Article 16

In the event of fraud, contravention or abuse, the Contracting Parties shall, notwithstanding the provisions of this Annex, be free to take proceedings against persons using temporary admission papers, for the recovery of the import duties and taxes and other sums payable and also for the imposition of any penalties to which such persons have rendered themselves liable. In such cases the associations shall lend their assistance to the Customs authorities.

Article 17

Temporary admission papers or parts thereof which have been issued or are intended to be issued in the territory into which they are imported and which are sent to an issuing association by a guaranteeing association, by an international organization or by the Customs authorities of a Contracting Party, shall be submitted free of import duties and taxes and free of any import prohibitions or restrictions. Corresponding facilities shall be granted at exportation.

Article 18

1

Each Contracting Party shall have the right to enter a reservation, in accordance with Article 29 of this Convention, in respect of the acceptance of ATA carnets for postal traffic.

2

No other reservation to this Annex shall be permitted.

Article 19

1

Upon its entry into force this Annex shall, in accordance with Article 27 of this Convention, terminate and replace the Customs Convention on the ATA carnet for the temporary admission of goods, Brussels 6 December 1961, (ATA Convention) in relations between the Contracting Parties which have accepted this Annex and are Contracting Parties to that Convention.

2

Notwithstanding the provisions of paragraph 1 of this Article, ATA carnets which have been issued under the terms of the ATA Convention prior to the entry into force of this Annex, shall be accepted until completion of the operations for which they were issued.

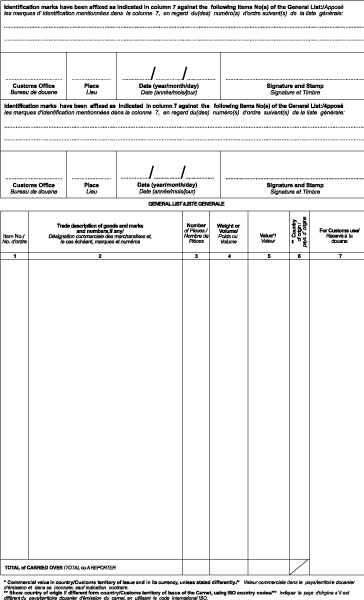

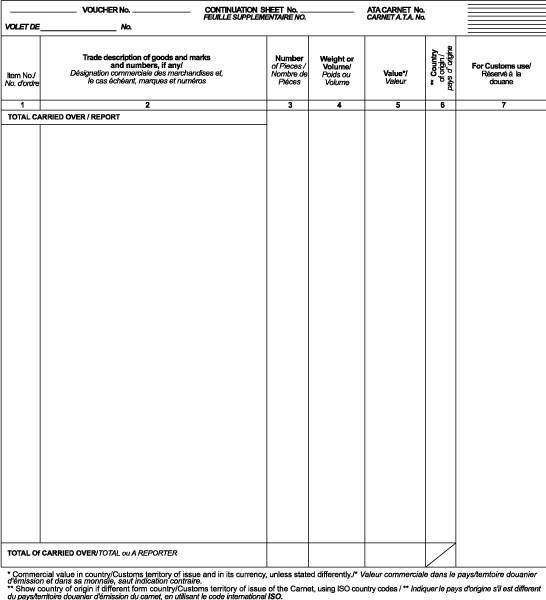

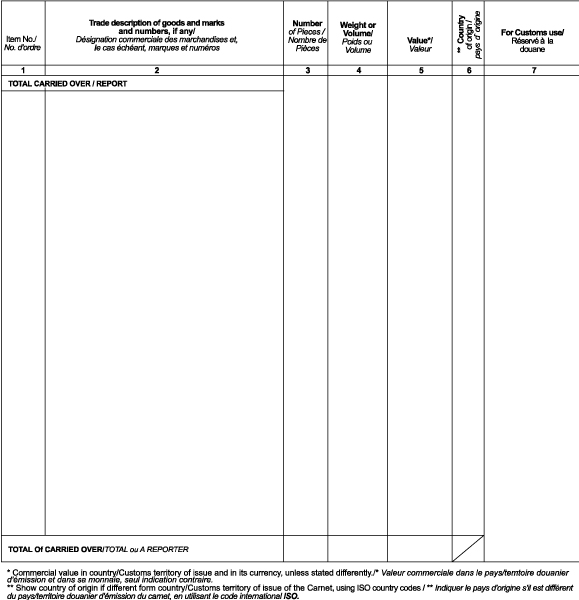

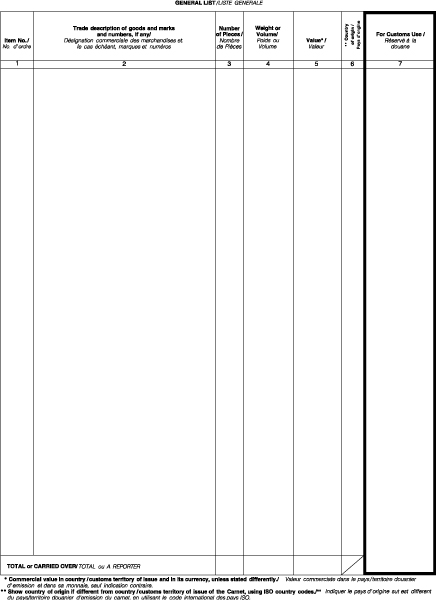

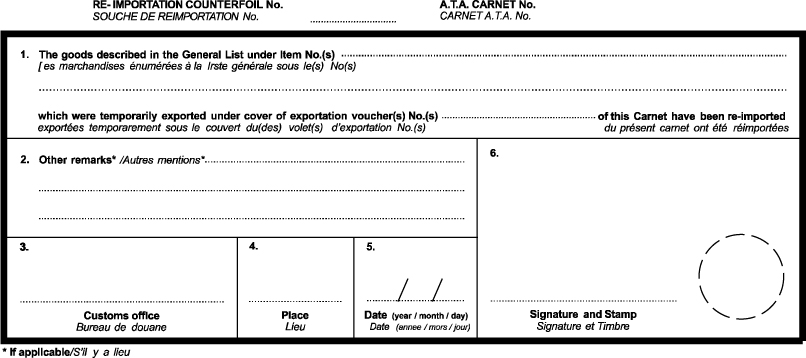

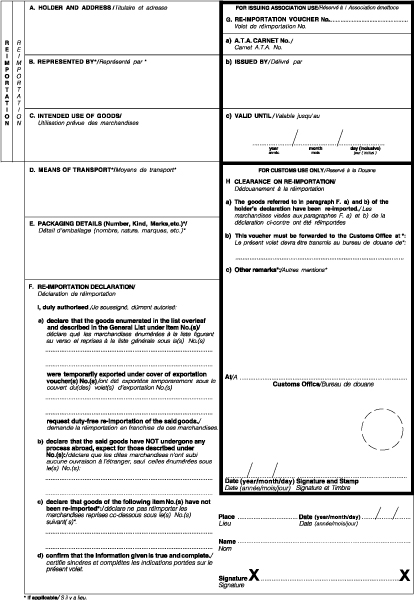

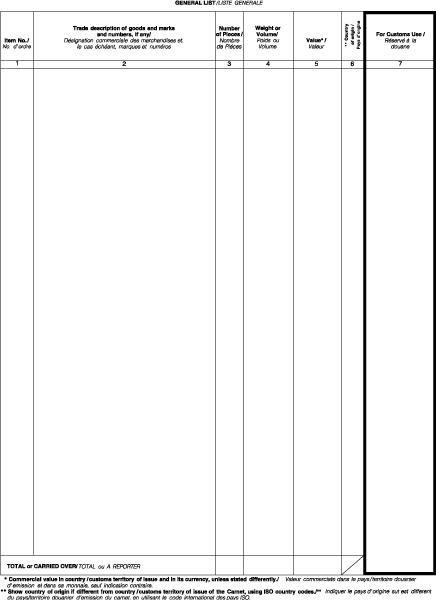

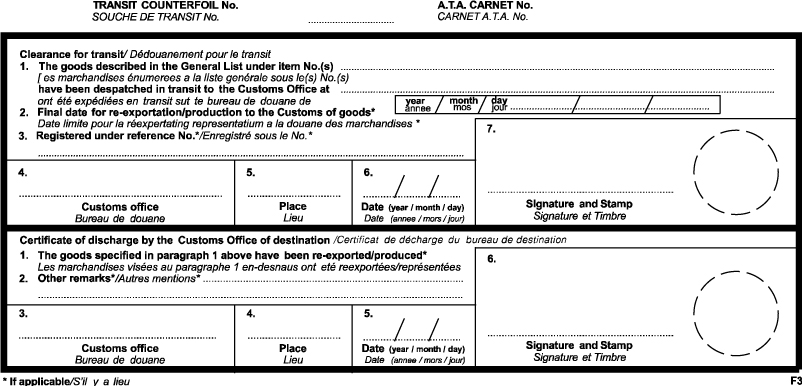

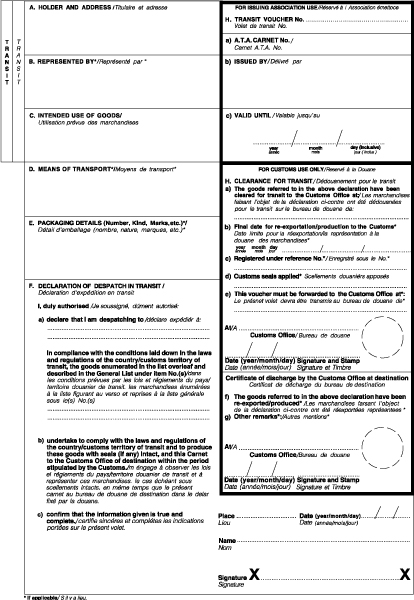

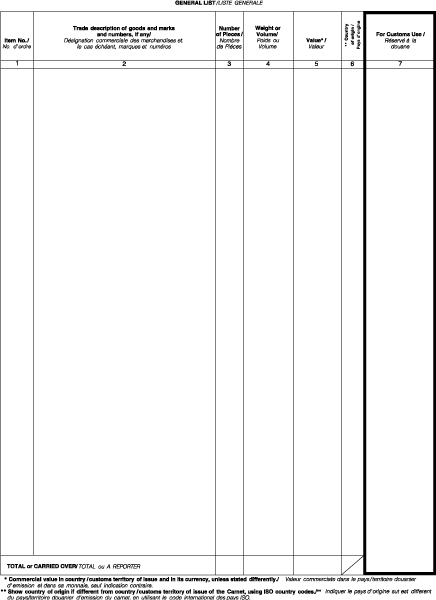

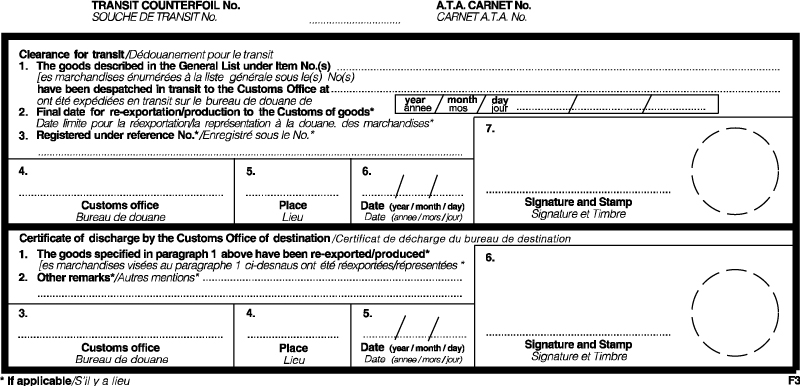

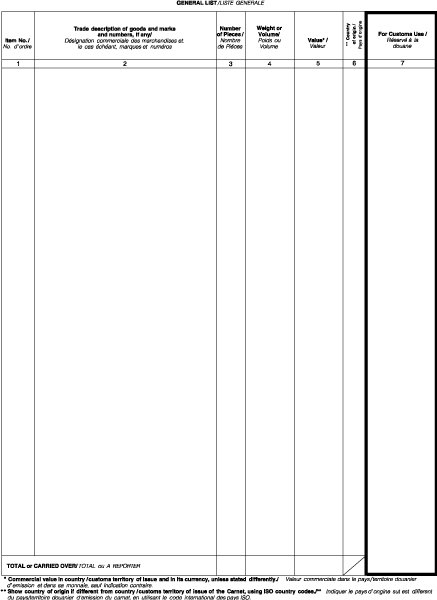

Appendix I.

to Annex A

Model of ATA carnet

The ATA carnet shall be printed in English or French and may also be printed in a second language.

The size of the ATA carnet shall be 297 × 210 mm

Notes on the use of the ATA carnet

1

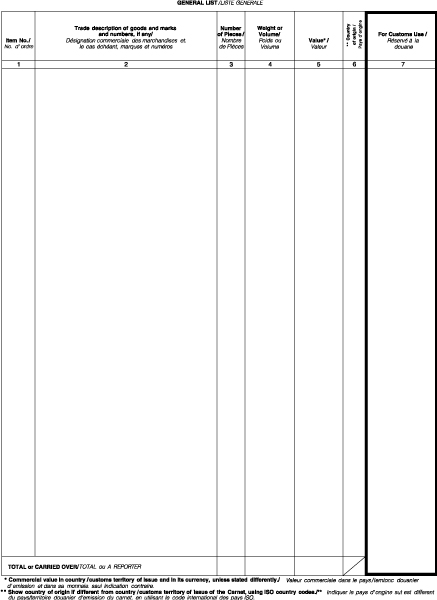

All goods covered by the Carnet shall be entered in columns 1 to 6 of the General List. If the space provided for the General List on the reverse of the front covers is unsufficient, continuation sheets conforming to the official model shall be used.

2

In order to close the General List, the totals of columns 3 and 5 shall be entered at the end of the list in figures and in writing. If the General List consists of several pages, the number of continuation sheets used shall be stated in figures and in writing at the foot of the list on the reverse of the front cover.

The lists on the vouchers shall be treated in the same way.

3

Each item shall be given an item number which shall be entered in column 1.

Goods comprising several separate parts (including spare parts and accessories) may be given a single item number. If so, the nature, the value and, if necessary, the weight of each separate part shall be entered in column 2 and only the total weight and value should appear in columns 4 and 5.

4

When making out the lists on the vouchers, the same item numbers shall be used as on the General List.

5

To facilitate Customs control, it is recommended that the goods (including separate parts thereof) be clearly marked with the corresponding item number.

6

Items answering to the same description may be grouped provided that each item so grouped is given a separate item number. If the items grouped are not of the same value, or weight, their respective values, and, if necessary, weights shall be specified in column 2.

7

If the goods are for exhibition, the importer is advised in his own interest to enter in C. of the importation voucher the name and address of the exhibition and of its organiser.

8

The Carnet shall be completed legibly and indelibly.

9

All goods covered by the Carnet should be examined and registered in the country/Customs territory of departure and for this purpose should be presented, together with the Carnet, to the Customs authorities there, except in cases where the Customs regulations of that country/Customs territory do not provide for such examination.

10

If the Carnet has been completed in a language other than that of the country/Customs territory of importation, the Customs authorities may require a translation.

11

Expired Carnets and Carnets which the holder does not intend to use again shall be returned by him to the issuing association.

12

Arabic numerals shall be used throughout.

13

In accordance with ISO Standard 8601, dates must be entered in the following order: year/month/day.

14

When blue Customs transit sheets are used, the holder is required to present the Carnet to the Customs office placing the goods in Customs transit and subsequently, within the time limit prescribed for Customs transit, to the specified Customs ‘office of destinations’. Customs must stamp and sign the Customs transit vouchers and counterfoils appropriately at each stage.

Appendix II.

to Annex A

Model of CPD carnet

Carnets used for CPD operations within a specific region may be printed in other combinations of United Nations official languages on the condition that one of the two languages is English or French.

The size of the CPD carnet shall be 21 × 29,7 cm.

The issuing association shall insert its name on each voucher and shall include the initials of the international guaranteeing chain to which it belongs.