Einde inhoudsopgave

Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II)

Article 123 Flood risk sub-module

Geldend

Geldend vanaf 08-07-2019

- Bronpublicatie:

08-03-2019, PbEU 2019, L 161 (uitgifte: 18-06-2019, regelingnummer: 2019/981)

- Inwerkingtreding

08-07-2019

- Bronpublicatie inwerkingtreding:

08-03-2019, PbEU 2019, L 161 (uitgifte: 18-06-2019, regelingnummer: 2019/981)

- Vakgebied(en)

Financieel recht / Europees financieel recht

Financieel recht / Financieel toezicht (juridisch)

Verzekeringsrecht / Europees verzekeringsrecht

Verzekeringsrecht / Bijzondere onderwerpen

1.

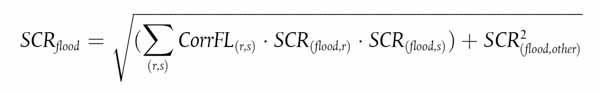

The capital requirement for flood risk shall be equal to the following:

where:

- (a)

the sum includes all possible combinations (r,s) of the regions set out in Annex VII;

- (b)

CorrFL(r,s) denotes the correlation coefficient for flood risk for region r and region s as set out in Annex VII;

- (c)

SCR(flood,r) and SCR(flood,s) denote the capital requirements for flood risk in region r and s respectively;

- (d)

SCR(flood,other) denotes the capital requirement for flood risk in regions other than those set out in Annex XIII.

2.

For all regions set out in Annex VII, the capital requirement for flood risk in a particular region r shall be the larger of the following capital requirements:

- (a)

the capital requirement for flood risk in region r according to scenario A as set out in paragraph 3;

- (b)

the capital requirement for flood risk in region r according to scenario B as set out in paragraph 4.

3.

For all regions set out in Annex VII, the capital requirement for flood risk in a particular region r according to scenario A shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from the following sequence of events:

- (a)

an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 65 % of the specified flood loss in region r;

- (b)

a loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 45 % of the specified flood loss in region r.

4.

For all regions set out in Annex VII, the capital requirement for flood risk in a particular region r according to scenario B shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from the following sequence of events:

- (a)

an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 100 % of the specified flood loss in region r;

- (b)

a loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to 10 % of the specified flood loss in region r.

5.

For all regions set out in Annex VII, the specified flood loss in a particular region r shall be equal to the following amount:

where:

- (a)

lapsed;

- (b)

the sum includes all possible combinations of risk zones (i,j) of region r set out in Annex IX;

- (c)

Corr(flood,r,i,j) denotes the correlation coefficient for flood risk in flood zones i and j of region r set out in Annex XXIV;

- (d)

WSI(flood,r,i) and WSI(flood,r,j) denote the weighted sums insured for flood risk in risk zones i and j of region r set out in Annex IX.

6.

For all regions set out in Annex VII and all risk zones of those regions set out in Annex IX, the weighted sum insured for flood risk in a particular flood zone i of a particular region r shall be equal to the following:

WSI(flood,r,i) = Q(flood,r) · W(flood,r,i) · SI(flood,r,i)

where:

- (a)

W(flood,r,i) denotes the risk weight for flood risk in risk zone i of region r set out in Annex X;

- (b)

SI(flood,r,i) denotes the sum insured for flood risk in flood zone i of region r;

- (c)

Q(flood,r) denotes the flood risk factor for region r as set out in Annex VII.

Where the amount determined for a particular risk zone in accordance with the first subparagraph exceeds an amount (referred to in this subparagraph as ‘the lower amount’) equal to the sum of the potential losses, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, that the insurance or reinsurance undertaking could suffer for flood risk in that risk zone, taking into account the terms and conditions of its specific policies, including any contractual payment limits, the insurance or reinsurance undertaking may, as an alternative calculation, determine the weighted sum insured for flood risk in that risk zone as the lower amount.

7.

For all regions set out in Annex VII and all risk zones of those regions set out in Annex IX, the sum insured for flood risk for a particular risk zone i of a particular region r shall be equal to the following:

SI(flood,r,i) = SI(property,r,i) + SI(onshore-property,r,i) + 1,5 · SI(motor,r,t)

where:

- (a)

SI(property,r,i) denotes the sum insured by the insurance or reinsurance undertaking for lines of business 7 and 19 as set out in Annex I in relation to contracts that cover flood risk, where the risk is situated in risk zone i of region r;

- (b)

SI(onshore-property,r,i) denotes the sum insured by the insurance or reinsurance undertaking for lines of business 6 and 18 as set out in Annex I in relation to contracts that cover onshore property damage by flood and where the risk is situated in risk zone i of region r;

- (c)

SI(motor,r,i) denotes the sum insured by the insurance or reinsurance undertaking for lines of business 5 and 17 as set out in Annex I in relation to contracts that cover flood risk, where the risk is situated in risk zone i of region r.

8.

The capital requirement for flood risk in regions other than those set out in Annex XIII, shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss in relation to each insurance and reinsurance contract that covers any of the following insurance or reinsurance obligations:

- (a)

obligations of lines of business 7 or 19 as set out in Annex I that cover flood risk, where the risk is not situated in one of the regions set out in Annex XIII;

- (b)

obligations of lines of business 6 or 18 as set out in Annex I in relation to onshore property damage by flood, where the risk is not situated in one of the regions set out in Annex XIII;

- (c)

obligations of lines of business 5 or 17 as set out in Annex I that cover flood risk, where the risk is not situated in one of the regions set out in Annex XIII.

9.

The amount of the instantaneous loss, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, referred to in paragraph 8 shall be equal to the following amount:

L(flood,other) = 1,1 · (0,5 · DIVflood + 0,5 · Pflood

where:

- (a)

DIVflood is calculated in accordance with Annex III, but based on the premiums in relation to the obligations referred to in points (a), (b) and (c) of paragraph 8 and restricted to the regions 5 to 18 set out in point (8) of Annex III;

- (b)

Pflood is an estimate of the premiums to be earned by the insurance or reinsurance undertaking for each contract that covers the obligations referred to in points (a), (b) and (c) of paragraph 8 during the following 12 months: for this purpose, premiums shall be gross, without deduction of premiums for reinsurance contracts.