Einde inhoudsopgave

Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II)

Article 133 Liability risk sub-module

Geldend

Geldend vanaf 18-01-2015

- Bronpublicatie:

10-10-2014, PbEU 2015, L 12 (uitgifte: 17-01-2015, regelingnummer: 2015/35)

- Inwerkingtreding

18-01-2015

- Bronpublicatie inwerkingtreding:

10-10-2014, PbEU 2015, L 12 (uitgifte: 17-01-2015, regelingnummer: 2015/35)

- Vakgebied(en)

Financieel recht / Europees financieel recht

Financieel recht / Financieel toezicht (juridisch)

Verzekeringsrecht / Europees verzekeringsrecht

Verzekeringsrecht / Bijzondere onderwerpen

1.

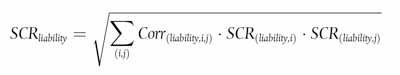

The capital requirement for liability risk shall be equal to the following:

where:

- (a)

the sum includes all possible combinations of liability risk groups (i,j) as set out in Annex XI;

- (b)

Corr(liability,i,j) denotes the correlation coefficient for liability risk of liability risk groups i and j as set out in Annex XI;

- (c)

SCR(liability,i) denotes the capital requirement for liability risk of liability risk group i.

2.

For all liability risk groups set out in Annex XI the capital requirement for liability risk of a particular liability risk group i shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is equal to the following:

L(liability,i) = f(liability,i) · P(liability,i)

where:

- (a)

f(liability,i) denotes the risk factor for liability risk group i as set out in Annex XI;

- (b)

P(liability,i) denotes the premiums earned by the insurance or reinsurance undertaking during the following 12 months in relation to insurance and reinsurance obligations in liability risk group i; for this purpose premiums shall be gross, without deduction of premiums for reinsurance contracts.

3.

The calculation of the loss in basic own funds referred to in paragraph 2 shall be based on the following assumptions:

- (a)

the loss of liability risk group i is caused by ni claims and the losses caused by these claims are representative for the business of the insurance or reinsurance undertaking in liability risk group i and sum up to the loss of liability risk group i;

- (b)

the number of claims ni is equal to the lowest integer that exceeds the following amount:

f(liability,i) · P(liability,i) / 1,15 · Lim(i,l)

where:

- (i)

f(liability,i) and P(liability,i) are defined as in paragraph 2;

- (ii)

Lim(i,1) denotes the largest liability limit of indemnity provided by the insurance or reinsurance undertaking in liability risk group i;

- (c)

where the insurance or reinsurance undertaking provides unlimited cover in liability risk group i, the number of claims ni is equal to one.