Einde inhoudsopgave

Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II)

Article 162 Accident concentration risk sub-module

Geldend

Geldend vanaf 18-01-2015

- Bronpublicatie:

10-10-2014, PbEU 2015, L 12 (uitgifte: 17-01-2015, regelingnummer: 2015/35)

- Inwerkingtreding

18-01-2015

- Bronpublicatie inwerkingtreding:

10-10-2014, PbEU 2015, L 12 (uitgifte: 17-01-2015, regelingnummer: 2015/35)

- Vakgebied(en)

Financieel recht / Europees financieel recht

Financieel recht / Financieel toezicht (juridisch)

Verzekeringsrecht / Europees verzekeringsrecht

Verzekeringsrecht / Bijzondere onderwerpen

1.

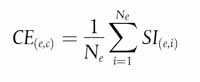

The capital requirement for the accident concentration risk sub-module shall be equal to the following:

where:

- (a)

the sum includes all countries c;

- (b)

SCR(ac,c) denotes the capital requirement for accident concentration risk of country c.

2.

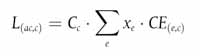

For all countries the capital requirement for accident concentration risk of country c shall be equal to the loss in basic own funds of insurance and reinsurance undertakings that would result from an instantaneous loss of an amount that, without deduction of the amounts recoverable from reinsurance contracts and special purpose vehicles, is calculated as follows:

where:

- (a)

Cc denotes the largest accident risk concentration of insurance and reinsurance undertakings in country c;

- (b)

the sum includes the event types e set out in Annex XVI;

- (c)

xe denotes the ratio of persons which will receive benefits of event type e as a result of the accident as set out in Annex XVI;

- (d)

CE(e,c) denotes the average value of benefits payable by insurance and reinsurance undertakings for event type e for the largest accident risk concentration in country c.

3.

For all countries, the largest accident risk concentration of an insurance or reinsurance undertaking in a country c shall be equal to the largest number of persons for which all of the following conditions are met:

- (a)

the insurance or reinsurance undertaking has a workers' compensation insurance or reinsurance obligation or an group income protection insurance or reinsurance obligation in relation to each of the persons;

- (b)

the obligations in relation to each of the persons cover at least one of the events set out in Annex XVI;

- (c)

the persons are working in the same building which is situated in country c.

4.

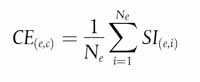

For all event types and countries, the average sum insured of an insurance or reinsurance undertaking for event type e for the largest accident risk concentration in country c shall be equal to the following:

where:

- (a)

Ne denotes the number of insured persons of the insurance or reinsurance undertaking which are insured against event type e and which belong to the largest accident risk concentration of the insurance or reinsurance undertaking in country c;

- (b)

the sum includes all the insured persons referred to in point (a);

- (c)

SI(e,i) denotes the value of the benefits payable by the insurance or reinsurance undertaking for the insured person i in case of event type e.

The value of the benefits referred to in point (c) shall be the sum insured or where the contract provides for recurring benefit payments the best estimate of the benefit payments in case of event type e. Where the benefits of an insurance policy depend on the nature or extent of the injury resulting from event e, the calculation of the value of the benefits shall be based on the maximum benefits obtainable under the policy, which are consistent with the event. For medical expense insurance and reinsurance obligations the value of the benefits shall be based on an estimate of the average amounts paid in case of event e, assuming the insured person is disabled for the duration specified and taking into account the specific guarantees the obligations include.

5.

Where Article 88 is complied with, insurance or reinsurance undertakings may calculate the value of the benefits payable by the insurance or reinsurance undertaking for the insured person referred to in paragraph 4 based on homogenous risk groups, provided that the grouping of policies complies with the requirements set out in Article 35.