Einde inhoudsopgave

Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II)

Article 204

Geldend

Geldend vanaf 18-01-2015

- Bronpublicatie:

10-10-2014, PbEU 2015, L 12 (uitgifte: 17-01-2015, regelingnummer: 2015/35)

- Inwerkingtreding

18-01-2015

- Bronpublicatie inwerkingtreding:

10-10-2014, PbEU 2015, L 12 (uitgifte: 17-01-2015, regelingnummer: 2015/35)

- Vakgebied(en)

Financieel recht / Europees financieel recht

Financieel recht / Financieel toezicht (juridisch)

Verzekeringsrecht / Europees verzekeringsrecht

Verzekeringsrecht / Bijzondere onderwerpen

1.

The capital requirement for the operational risk module shall be equal to the following:

SCROperational = min(0,3 · BSCR;Op) + 0,25 · Expul

where:

- (a)

BSCR denotes the Basic Solvency Capital Requirement;

- (b)

Op denotes the basic capital requirement for operational risk charge;

- (c)

Expul denotes the amount of expenses incurred during the previous 12 months in respect of life insurance contracts where the investment risk is borne by policy holders.

2.

The basic capital requirement for operational risk shall be calculated as follows:

Op = max(Oppremiums;Opprovisions)

where:

- (a)

Oppremiums denotes the capital requirement for operational risks based on earned premiums;

- (b)

Opprovisions denotes the capital requirement for operational risks based on technical provisions.

3.

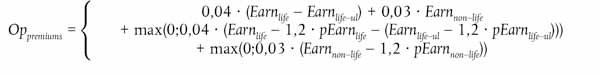

The capital requirement for operational risks based on earned premiums shall be calculated as follows:

where:

- (a)

Earnlife denotes the premiums earned during the last 12 months for life insurance and reinsurance obligations, without deducting premiums for reinsurance contracts;

- (b)

Earnlife-ul denotes the premiums earned during the last 12 months for life insurance and reinsurance obligations where the investment risk is borne by the policy holders without deducting premiums for reinsurance contracts;

- (c)

Earnnon-life denotes the premiums earned during the last 12 months for non-life insurance and reinsurance obligations, without deducting premiums for reinsurance contracts;

- (d)

pEarnlife denotes the premiums earned during the 12 months prior to the last 12 months for life insurance and reinsurance obligations, without deducting premiums for reinsurance contracts;

- (e)

pEarnlife-ul denotes the premiums earned during the 12 months prior to the last 12 months for life insurance and reinsurance obligations where the investment risk is borne by the policy holders without deducting premiums for reinsurance contracts;

- (f)

pEarnnon-life denotes the premium earned during the 12 months prior to the last 12 months for non-life insurance and reinsurance obligations, without deducting premiums for reinsurance contracts.

For the purposes of this paragraph, earned premiums shall be gross, without deduction of premiums for reinsurance contracts.

4.

The capital requirement for operational risk based on technical provisions shall be calculated as follows:

Opprovisions = 0,0045 · max(0; TPlife − TPlife-ul) + 0,03 · max (0;TPnon-life)

where:

- (a)

TPlife denotes the technical provisions for life insurance and reinsurance obligations;

- (b)

TPlife-ul denotes the technical provisions for life insurance obligations where the investment risk is borne by the policy holders;

- (c)

TPnon-life denotes the technical provisions for non-life insurance and reinsurance obligations.

For the purposes of this paragraph, technical provisions shall not include the risk margin, and shall be calculated without deduction of recoverables from reinsurance contracts and special purpose vehicles.