Einde inhoudsopgave

Delegated Regulation (EU) 2015/35 supplementing Directive 2009/138/EC of the European Parliament and of the Council on the taking-up and pursuit of the business of Insurance and Reinsurance (Solvency II)

Article 168a Qualifying unlisted equity portfolios

Geldend

Geldend vanaf 08-07-2019

- Bronpublicatie:

08-03-2019, PbEU 2019, L 161 (uitgifte: 18-06-2019, regelingnummer: 2019/981)

- Inwerkingtreding

08-07-2019

- Bronpublicatie inwerkingtreding:

08-03-2019, PbEU 2019, L 161 (uitgifte: 18-06-2019, regelingnummer: 2019/981)

- Vakgebied(en)

Financieel recht / Europees financieel recht

Financieel recht / Financieel toezicht (juridisch)

Verzekeringsrecht / Europees verzekeringsrecht

Verzekeringsrecht / Bijzondere onderwerpen

1.

For the purposes of point (e) of Article 168(6), a qualifying unlisted equity portfolio is a set of equity investments that meets all of the following requirements:

- (a)

the set of investments consists solely of investments in the ordinary shares of companies;

- (b)

the ordinary shares of each of the companies concerned are not listed in any regulated market;

- (c)

each company has its head office in a country which is a member of the EEA;

- (d)

more than 50 % of the annual revenue of each company is denominated in currencies of countries which are members of the EEA or the OECD;

- (e)

more than 50 % of the staff employed by each company have their principal place of work in countries which are members of the EEA;

- (f)

each company fulfils at least one of the following conditions for each of the last three financial years ending prior to the date on which the Solvency Capital Requirement is being calculated:

- (i)

the annual turnover of the company exceeds EUR 10 000 000;

- (ii)

the balance sheet total of the company exceeds EUR 10 000 000;

- (iii)

the number of staff employed by the company exceeds 50;

- (g)

the value of the investment in each company represents no more than 10 % of the total value of the set of investments;

- (h)

none of the companies is an insurance or reinsurance undertaking, a credit institution, an investment firm, a financial institution, an alternative investment fund manager, a UCITS management company, an institution for occupational retirement provision or a non-regulated undertaking carrying out financial activities;

- (i)

the beta of the set of investments does not exceed 0,796.

2.

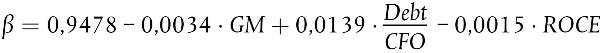

For the purposes of paragraph 1(i), the beta of a set of investments is the average of the betas for each of the investments in that set of investments, weighted by the book values of those investments. The beta of an investment in a company shall be determined as follows:

where:

- (a)

β is the beta of the equity investment in the company;

- (b)

GM is the average gross margin for the company over the last five financial years ending prior to the date on which the Solvency Capital Requirement is being calculated;

- (c)

Debt is the total debt of the company at the end of the most recent financial year for which figures are available;

- (d)

CFO is the average net cash-flow for the company from operations over the last five financial years ending prior to the date on which the Solvency Capital Requirement is being calculated;

- (e)

ROCE is the average return on common equity for the company over the last five financial years ending prior to the date on which the Solvency Capital Requirement is being calculated. Common equity shall be understood as capital and reserves as referred to in Annex III to Directive 2013/34/EU of the European Parliament and of the Council (1) excluding preference shares and the related share premium account.

Voetnoten

Directive 2013/34/EU of the European Parliament and of the Council of 26 June 2013 on the annual financial statements, consolidated financial statements and related reports of certain types of undertakings, amending Directive 2006/43/EC of the European Parliament and of the Council and repealing Council Directives 78/660/EEC and 83/349/EEC (OJ L 182, 29.6.2013, p. 19).