Einde inhoudsopgave

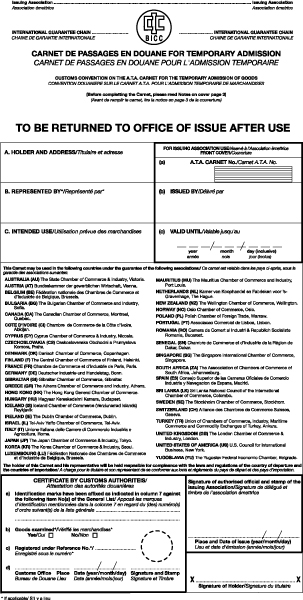

Customs Convention on the A.T.A. carnet for the temporary admission of goods (A.T.A. Convention)

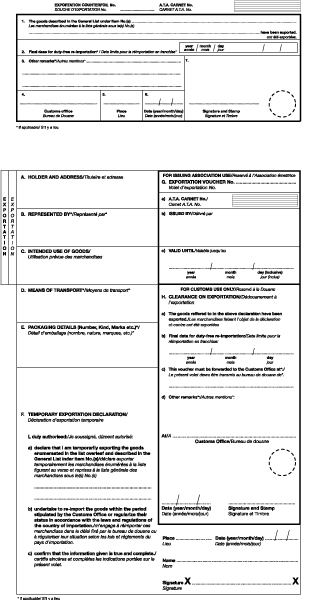

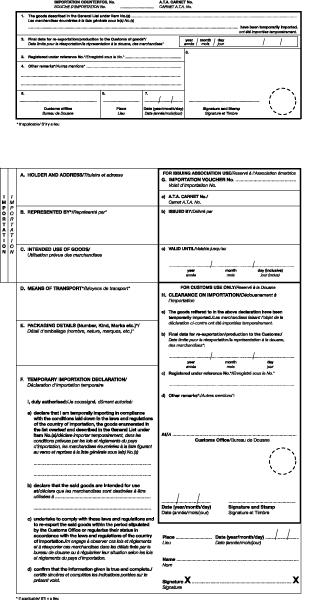

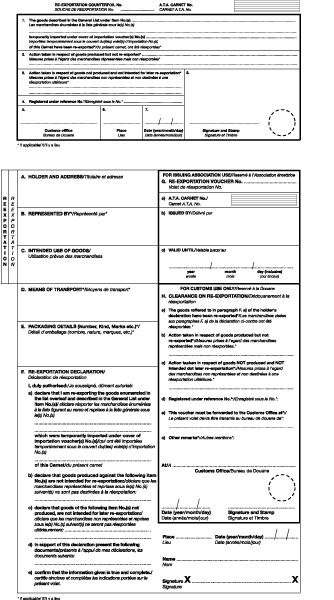

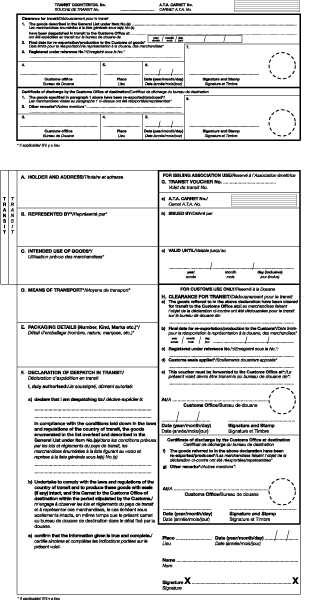

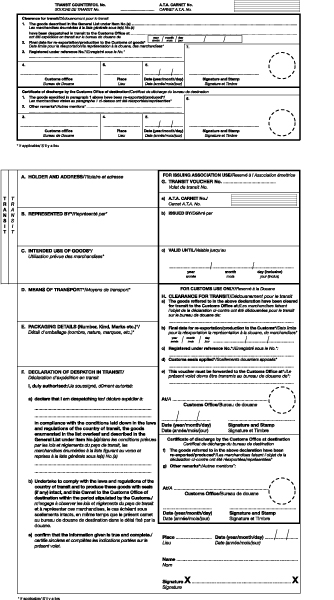

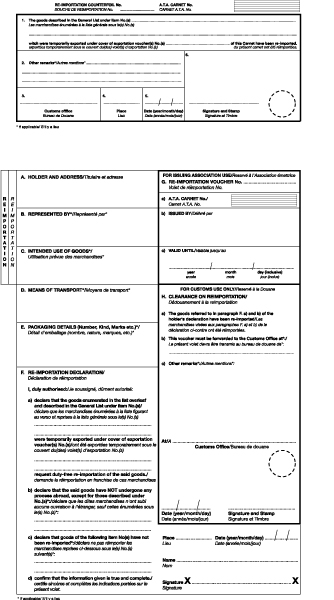

Annex Model of the A.T.A. Carnet

Geldend

Geldend vanaf 04-11-1989

- Bronpublicatie:

26-11-1987, Trb. 1989, 144 (uitgifte: 01-01-1989, kamerstukken/regelingnummer: -)

- Inwerkingtreding

04-11-1989

- Bronpublicatie inwerkingtreding:

26-11-1987, Trb. 1989, 144 (uitgifte: 01-01-1989, kamerstukken/regelingnummer: -)

- Vakgebied(en)

Accijns en verbruiksbelastingen (V)

Internationaal belastingrecht (V)

Douane (V)

Notes on the use of the A.T.A. Carnet

1

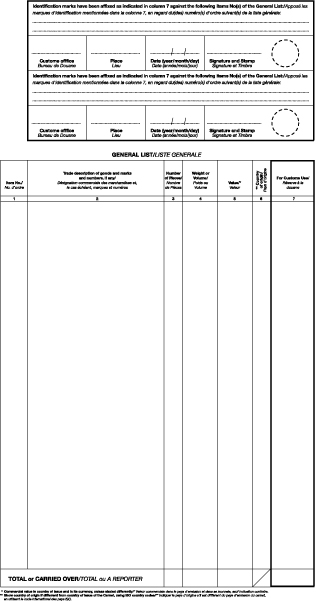

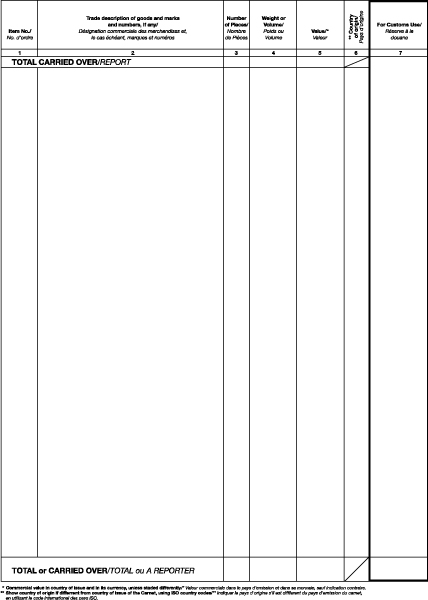

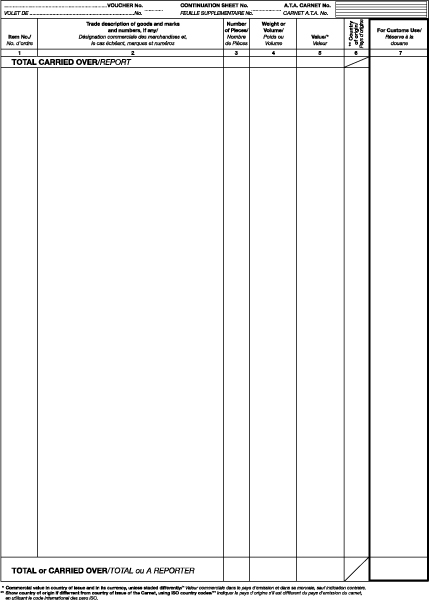

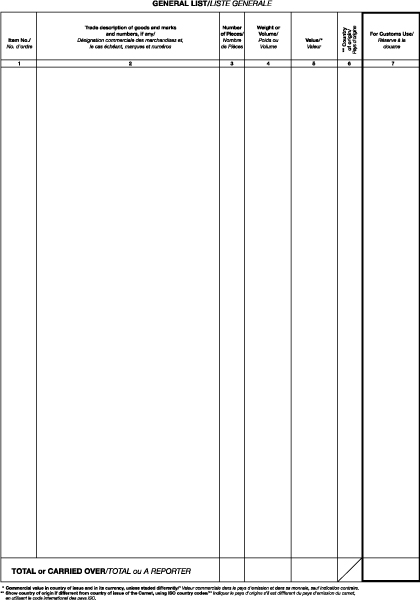

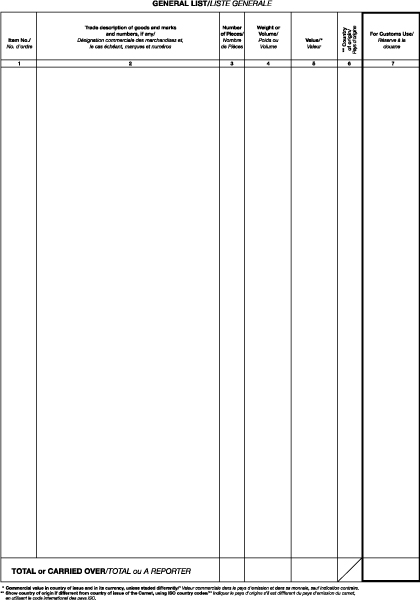

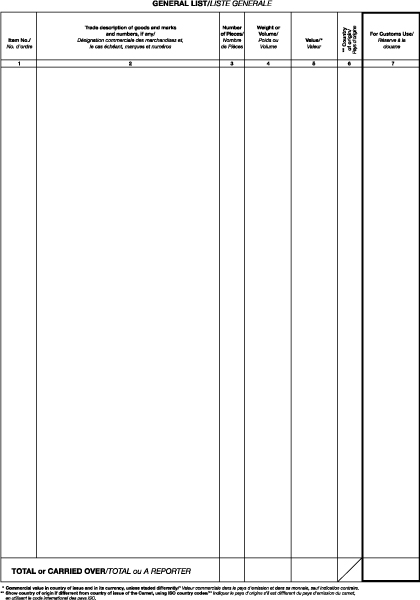

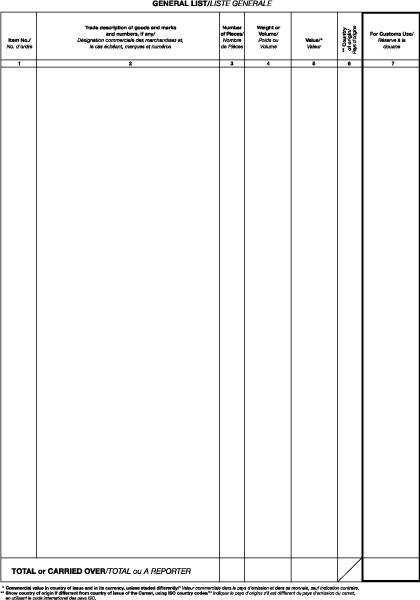

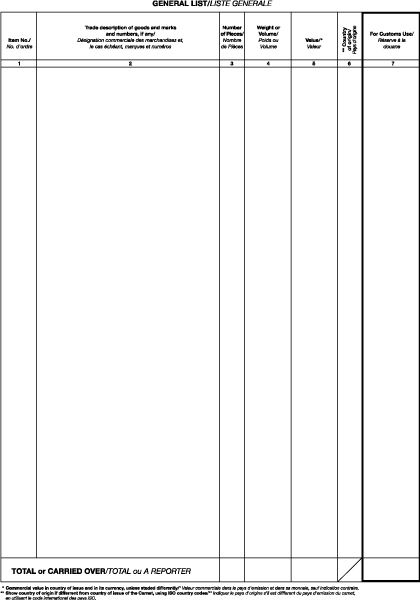

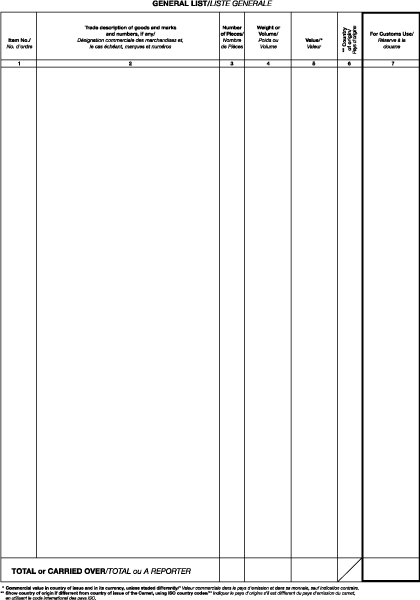

All goods covered by the Carnet shall be entered in columns 1 to 6 of the General List. If the space provided for the General List on the reverse of the front covers is insufficient, continuation sheets conforming to the official model shall be used.

2

In order to close the General List, the totals of columns 3 and 5 shall be entered at the end of the list in figures and in writing. If the General List consists of several pages, the number of continuation sheets used shall be stated in figures and in writing at the foot of the list on the reverse of the front cover.

The lists on the vouchers shall be treated in the same way.

3

Each item shall be given an item number which shall be entered in column 1.

Goods comprising several separate parts (including spare parts and accessories) may be given a single item number. If so, the nature, the value and, if necessary, the weight of each separate part shall be entered in column 2 and only the total weight and value should appear in columns 4 and 5.

4

When making out the lists on the vouchers, the same item numbers shall be used as on the General List.

5

To facilitate Customs control, it is recommended that the goods (including separate parts thereof) be clearly marked with the corresponding item number.

6

Items answering to the same description may be grouped provided that each item so grouped is given a separate item number. If the items grouped are not of the same value, or weight, their respective values, and, if necessary, weights shall be specified in column 2.

7

If the goods are for exhibition, the importer is advised in his own interest to enter in C. of the importation voucher the name and address of the exhibition and of its organiser.

8

The Carnet shall be completed legibly and indelibly.

9

All goods covered by the Carnet should be examined and registered in the country of departure and for this purpose should be presented, together with the carnet, to the Customs authorities there, except in cases where the Customs regulations of that country do not provide for such examination.

10

If the Carnet has been completed in a language other than that of the country of importation, the Customs authorities may require a translation.

11

Expired Carnets and Carnets which the holder does not intend to use again shall be returned by him to the issuing association.

12

Arabic numerals shall be used throughout.

13

In accordance with ISO Standard 8601, dates must be entered in the following order: year/month/day.

14

When blue transit sheets are used, the holder is required to present the Carnet to the Customs office placing the goods in transit and subsequently, within the time limit prescribed for transit, to the specified Customs ‘office of destination’. Customs must stamp and sign the transit vouchers and counterfoils appropriately at each stage.

INTERNATIONAL CHAMBER OF COMMERCE

INTERNATIONAL BUREAU OF CHAMBERS OF COMMERCE